Page 5 - 1797_Value Plus Aug 2016

P. 5

Shemaroo Entertainment Ltd. FUNDAMENTAL

BUY Target Price Rs 392 STOCK

Value Parameters 532528 Company Overview

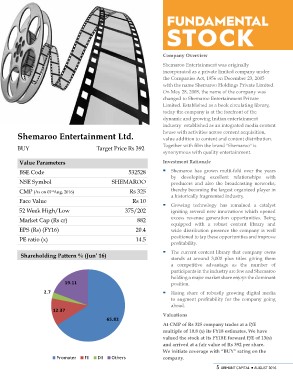

BSE Code SHEMAROO

NSE Symbol Shemaroo Entertainment was originally

CMP (As on 01stAug, 2016) Rs 325 incorporated as a private limited company under

Face Value Rs 10 the Companies Act, 1956 on December 23, 2005

52 Week High/Low 375/202 with the name Shemaroo Holdings Private Limited.

Market Cap (Rs cr) On May 28, 2008, the name of the company was

EPS (Rs) (FY16) 882 changed to Shemaroo Entertainment Private

PE ratio (x) 20.4 Limited. Established as a book circulating library,

14.5 today the company is at the forefront of the

dynamic and growing Indian entertainment

Shareholding Pattern % (Jun’ 16) industry established as an integrated media content

house with activities across content acquisition,

19.11 value addition to content and content distribution.

2.7 Together with film the brand "Shemaroo" is

synonymous with quality entertainment.

12.37

Investment Rationale

65.82

§ Shemaroo has grown multi-fold over the years

Promoter FII DII Others by developing excellent relationships with

producers and also the broadcasting networks,

thereby becoming the largest organized player in

a historically fragmented industry.

§ Growing technology has remained a catalyst

igniting several new innovations which opened

excess revenue generation opportunities. Being

equipped with a robust content library and

wide distribution presence the company is well

positioned to tap these opportunities and improve

profitability.

§ The current content library that company owns

stands at around 3,000 plus titles giving them

a competitive advantage as the number of

participants in the industry are few and Shemaroo

holding a major market share enjoys the dominant

position.

§ Rising share of robustly growing digital media

to augment profitability for the company going

ahead.

Valuations

At CMP of Rs 325 company trades at a P/E

multiple of 10.8 (x) its FY18 estimates. We have

valued the stock at its FY18E forward P/E of 13(x)

and arrived at a fair value of Rs 392 per share.

We initiate coverage with “BUY” rating on the

company.

5 ARIHANT CAPITAL ¡ AUGUST 2016