Page 4 - Value Plus

P. 4

fundamental

stock

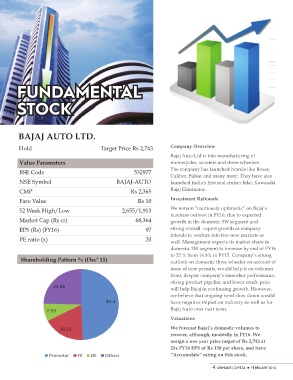

BAJAJ AUTO LTD.

Hold Target Price Rs 2,743 Company Overview

Value Parameters 532977 Bajaj Auto Ltd is into manufacturing of

BSE Code BAJAJ-AUTO motorcycles, scooters and three-wheelers.

NSE Symbol The company has launched brands like Boxer,

CMP Rs 2,365 Caliber, Pulsar and many more. They have also

Face Value Rs 10 launched India's first real cruiser bike, Kawasaki

52 Week High/Low Bajaj Eliminator.

Market Cap (Rs cr) 2,655/1,913

EPS (Rs) (FY16) 68,364 Investment Rationale

PE ratio (x) 97

20 We remain “cautiously optimistic” on Bajaj’s

business outlook in FY16, due to expected

Shareholding Pattern % (Dec’ 15) growth in the domestic 3W segment and

strong overall export growth as company

intends to venture into few new markets as

well. Management expects its market share in

domestic 2W segment to increase by end of FY16

to 22 % from 16.8% in FY15. Company’s strong

outlook on domestic three wheeler on account of

issue of new permits, would help it on volumes

front, despite company’s smoother performance,

strong product pipeline and lower crude price

will help Bajaj in continuing growth. However,

we believe that ongoing rural slow down would

have negative impact on industry as well as for

Bajaj Auto over near term.

Valuations

We forecast Bajaj’s domestic volumes to

recover, although, modestly in FY16. We

assign a one year price target of Rs 2,743 at

21x FY16 EPS of Rs 130 per share, and have

“Accumulate” rating on this stock.

4 ARIHANT CAPITAL ¡ FEBRUARY 2016