Page 4 - 2274_Value_Plus_Nov_2016

P. 4

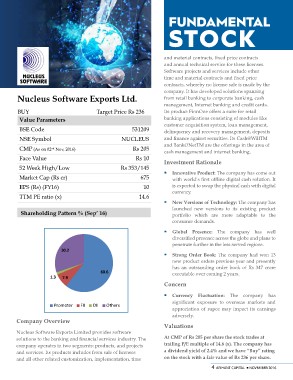

Nucleus Software Exports Ltd. FUNDAMENTAL

BUY Target Price Rs 236 STOCK

Value Parameters

BSE Code 531209 and material contracts, fixed price contracts

NSE Symbol NUCLEUS and annual technical service for these licenses.

CMP (As on 02nd Nov, 2016) Software projects and services include other

Face Value Rs 205 time and material contracts and fixed price

52 Week High/Low Rs 10 contracts, whereby no license sale is made by the

Market Cap (Rs cr) Rs 353/145 company. It has developed solutions spanning

EPS (Rs) (FY16) from retail banking to corporate banking, cash

TTM PE ratio (x) 675 management, Internet banking and credit cards.

10 Its product FinnOne offers a suite for retail

14.6 banking applications consisting of modules like

customer acquisition system, loan management,

Shareholding Pattern % (Sep’ 16) delinquency and recovery management, deposits

and finance against securities. Its Cash@WillTM

30.2 60.6 and BankONetTM are the offerings in the area of

1.3 7.9 cash management and internet banking.

Promoter FII DII Others Investment Rationale

Company Overview § Innovative Product: The company has come out

with world’s first offline digital cash solution. It

Nucleus Software Exports Limited provides software is expected to swap the physical cash with digital

solutions to the banking and financial services industry. The currency.

company operates in two segments: products, and projects

and services. Its products includes from sale of licenses § New Versions of Technology: The company has

and all other related customization, implementation, time launched new versions to its existing product

portfolio which are more adaptable to the

consumer demands.

§ Global Presence: The company has well

diversified presence across the globe and plans to

penetrate further in the less served regions.

§ Strong Order Book: The company had won 13

new product orders previous year and presently

has an outstanding order book of Rs 347 crore

executable over coming 2 years.

Concern

§ Currency Fluctuation: The company has

significant exposure to overseas markets and

appreciation of rupee may impact its earnings

adversely.

Valuations

At CMP of Rs 205 per share the stock trades at

trailing P/E multiple of 14.6 (x). The company has

a dividend yield of 2.4% and we have “Buy” rating

on the stock with a fair value of Rs 236 per share.

4 ARIHANT CAPITAL ¡ NOVEMBER 2016