Page 4 - 1411_Value Plus june 2016

P. 4

TECHNICAL

PICK

Apollo Hospitals Enterprise Ltd Buy Apollo Hospitals Enterprise Limited is a provider

CMP: ` 1413.45 (As on 01st Jun, 2016) of healthcare services in India and internationally.

Buy : ` 1406-1380 The company’s healthcare facilities include primary,

Target Price : ` 1470-1500 secondary, and tertiary care facilities. The tertiary care

Stop-Loss: ` 1325 hospitals provides advanced levels of care in over

50 specialties, including cardiac sciences, oncology,

Apollo Hospitals neurosciences, critical care, orthopedics, radiology,

Enterprises Ltd. gastroenterology, and transplants. In addition, it is

focused on technology based treatment areas such as

minimally invasive surgery, robotics and technology

for cancer. As of May 28, 2015, it operated 55 hospitals

with 9,200 beds, 1,822 retail pharmacies, 106 primary

care and diagnostic clinics, 100 telemedicine units, 15

colleges of nursing and hospital management and 1

research foundation. It also operates retail healthcare

centres including dental clinics and lifestyle birthing

centres. It also offers health insurance services and

projects consultancy.

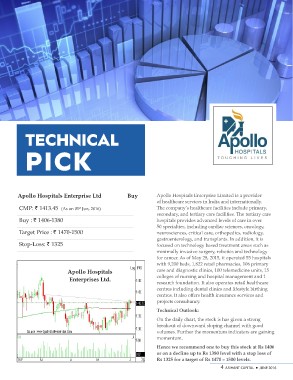

Technical Outlook:

On the daily chart, the stock is has given a strong

breakout of downward sloping channel with good

volumes. Further the momentum indicators are gaining

momentum.

Hence we recommend one to buy this stock at Rs 1406

or on a decline up to Rs 1380 level with a stop loss of

Rs 1325 for a target of Rs 1470 – 1500 levels.

4 ARIHANT CAPITAL ¡ JUNE 2016